In this case, your assets usually represent your initial investment, the starting capital of the business. You might also have a business loan to help you kick-start your operation and the supplies. The final step of this journey is to create equity accounts and assign balances to them. Next, you might want to create your liability accounts and enter their initial (or opening, if you will) balances.

Looking To Get Started?

Basically, they act as the part of the cumulative profit that is held or retained for future use. They are reported under the shareholder’s equity section of the balance sheet. Proper financial reporting also facilitates strategic planning and resource allocation, contributing to the overall success and sustainability of the business. To initiate the process of fixing Opening Balance Equity in QuickBooks Online, the first step involves verifying the accuracy and completeness of the Opening Balance Equity account within the accounting system. Opening Balance Equity in QuickBooks Online represents the discrepancy between the actual and expected balances during the transition to a new accounting system or the start of a new fiscal year. Are you struggling to understand and fix the opening balance equity in QuickBooks Online?

AccountingTools

The opening balance account may not display on the balance sheet in case the balance is zero. This crucial step not only helps in maintaining financial accuracy but also allows small businesses to have a clear understanding of their financial position. Unreconciled transactions can significantly impact the accuracy of a company’s financial statements, leading to misrepresentation of financial performance. Timely identification and resolution of these discrepancies are vital for the overall health of the business.

- The best way to fix or eliminate Opening Balance Equity is to make a journal entry transferring the amount to the proper accounts.

- Here’s how to enter an opening balance for accounts you create in QuickBooks.

- Auditors assess the valuation and completeness of these records, ensuring that the equity balance is reflective of the company’s true financial state at the point of transition.

- At this point, to zero this balance, you might want to distribute it to the correct accounts.

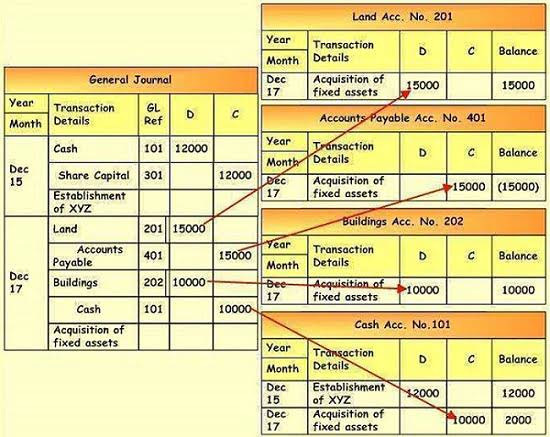

- For example, if you have an asset account like a checking account, and a balance of $50 is added to accounting software, then the other account must be provided $50 to make your balance sheet balanced.

What Is General Ledger In Quickbooks

- Opening Balance Equity is a temporary account that is used to record the initial equity balance when a new company’s books are set up.

- As soon as you start setting your asset accounts with opening balances in the chart of accounts, QuickBooks will put the equal balance amounts to this account to offset them and, this way, balance the equation.

- An opening balance is the amount in a financial account when a new period begins, like a new year or month (it also applies to when you set up a new company file in QuickBooks).

- By utilizing the journal entry, the erroneous opening balance equity amounts are corrected, leading to a more precise representation of the company’s equity position.

- If the amount of the journal accounting entry does not support the amount on your bank statement and you close it out, the software will rearrange the opening balance equity account balance.

Book your seat at our Weekly Public Demo to see how you can do it with Synder, or explore it yourself with a 15-day all-inclusive free trial. Let’s try to beat up the confusion about the opening balance equity account and figure out its purpose and how to reconcile it in QuickBooks to present professional balance sheets to banks, auditors, and potential investors. The significance of Opening Balance Equity extends beyond mere numbers on a ledger; it ensures continuity and accuracy in financial reporting.

Resources for Your Growing Business

Regular reconciliations and ongoing monitoring of your accounts will help maintain the accuracy of your records as your business evolves. Remember to keep backups of your company file and maintain proper documentation of your opening balances and any subsequent adjustments. These practices will help maintain the integrity and reliability of your financial what is opening balance equity records as you continue to use QuickBooks for your business’s accounting needs. Once you have entered the opening balances for your sales tax codes, you have completed the process of entering opening balances in QuickBooks. It’s recommended to review and finalize all the opening balances to ensure their accuracy and consistency with your financial records.

Save and Close the Journal Entry

Zeroing out the Opening Balance Equity in QuickBooks Online involves the creation of a journal entry to address any discrepancies and ensure the accuracy of financial statements and equity accounts. Opening Balance Equity is an account created by QuickBooks to offset any beginning balances entered in the chart of accounts. You can avoid an Open Balance Equity account by ensuring the equality of debits and credits of your beginning balances. We’ll discuss how to avoid an Opening Balance Equity account and how to fix or eliminate it. As you enter the initial balances for your accounts, QuickBooks calculates the total of all the balances entered.

What Is Opening Balance Equity In QuickBooks Online and Desktop And How to Manage It

This scrutiny helps to maintain the credibility of the financial statements, providing assurance to stakeholders that the company’s financial position is presented fairly. The best practice is to close opening balance equity accounts off to retained earnings or owner’s equity accounts. A professional bookkeeper will help you ensure your books are up-to-date and accurate.

Reasons Why You Have a QuickBooks Opening Balance Equity Account

Opening Balance Equity accounts show up under the equity section of a balance sheet along with the other equity accounts like retained earnings but may not show up on the opening balance sheet if the balance is zero. If you have been asking yourself, “What is opening balance equity https://www.bookstime.com/articles/incremental-cost on a balance sheet? We will go over opening balance equity, the reasons it’s created, and how to close it out so your balance sheets are presentable to banks, auditors, and potential investors. On the left hand side of the accounting equation the assets increase by 63,500.